Bristol-Myers Squibb’s three-year collaboration with Flatiron Health will focus on leveraging real-world data to improve the pharmaceutical company’s regulatory submissions, demonstrate the economic value of BMS’s cancer portfolio, and to study the predictive value of biomarkers.

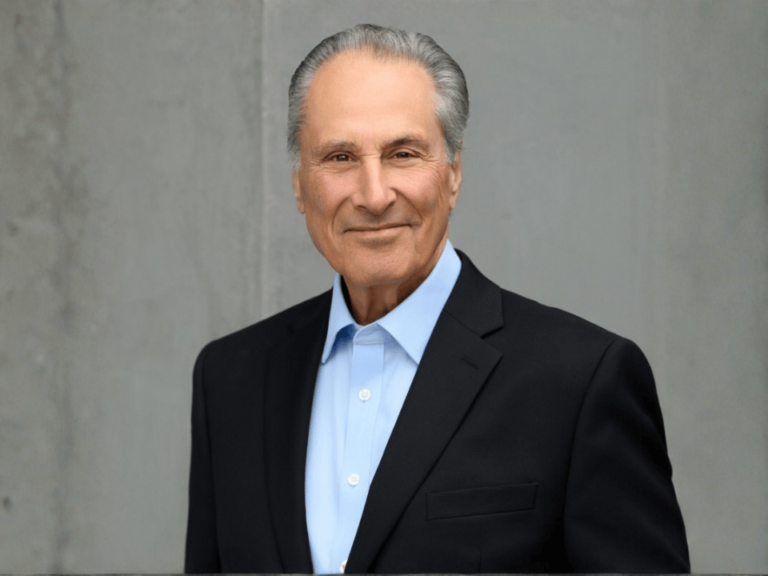

“Contemplating clinical endpoints is very important when we start thinking early in discovery about which targets and pathways to modulate. We continually challenge ourselves by asking if perturbing those cellular pathways will lead to a disease phenotypic change, which we can measure by endpoints that align with those that the regulatory agencies would find acceptable,” said Saurabh Saha, senior vice president of research and development and global head of translational medicine at BMS. “That’s incredibly important to us, especially in translational medicine.

“To your question, we, along with others in the industry, will be looking at these large, aggregated datasets to potentially help define new endpoints.”

Saha spoke with Matthew Ong, a reporter with The Cancer Letter

Matthew Ong: What is the nature of BMS’s collaboration with Flatiron?

Saurabh Saha: We’ve had a relationship with Flatiron since 2014, and it’s been very productive. With Roche’s recent acquisition of Flatiron, we are encouraged by the investment in Flatiron’s vision to expand the industry’s overall use of real world evidence.

So, why is that important for BMS specifically?

I lead the Translational Medicine group at BMS, and our goals are twofold. First, we seek to investigate options that could provide patients with as much treatment optionality as possible based on the profile of their disease. Second, we strive to achieve increased speed and success of our assets as they progress from discovery through clinical development.

We see the relationship with Flatiron, and leveraging real-world data in general, as a core component toward achieving both of those goals.

This week we announced a three-year extension of the collaboration with Flatiron that we started four years ago.

How much is BMS investing in this collaboration?

SS: We have not disclosed any of the financial specifics of the relationship.

Does BMS have similar partnerships or collaborations with other data companies?

SS: We’re committed to advancing digital health, and are strengthening our capabilities across the company. As an example, we’re incorporating digital health technologies to progress assets in R&D spanning the continuum from discovery, translational medicine, and development, and even to the commercial setting.

We are using real-world data from Flatiron, public sources and other entities to increase the company’s capability around regulatory submissions, demonstrating the economic value of our medicines. And, in understanding the predictive value of biomarkers, we will be able to design smarter, more efficient trials and increase the speed of patient enrollment in those trials.

Digital health is a very core capability that we’re incorporating across most functions of the company, and our work with Flatiron is certainly a part of those efforts.

Where does Flatiron stand, in your opinion, in the field in terms of their work on real-world evidence?

SS: Not having seen an analysis of all the various entities—either emerging or established in the EHR or real-world data field—I cannot comment on how they equate.

However, I am able to share perspective on our engagement with Flatiron in the past. In the oncology space, they have effectively captured and converted structured and unstructured data into very useful data. This was unimaginable just a few years ago.

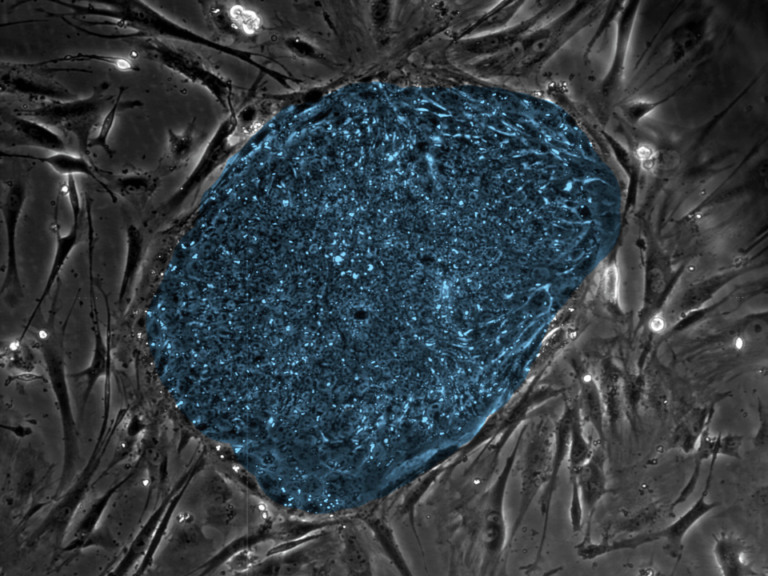

In fact, the intersection of genomics and patient phenotypic data is the sweet spot, aligning with where we seek to make key discoveries in translational medicine. The analysis of tumor somatic mutation data, germline sequencing data and other -omics technologies, combined with information about the patient’s tumor type, histology, demographics, medications, and treatment outcomes provides a rich source of data.

That integrated dataset—and the various intersections of the data on a patient-by-patient level and on an aggregate level—can give us insights to help formulate hypotheses. What’s really exciting is not only the possibility of hypothesis generating from these rich datasets, but also being able to answer specific questions.

A year ago, we published data from Flatiron on real-time uptake of drugs, but now, it sounds like we’re able to reliably track outcomes and other variables. What’s your take on where the field is now with real-world data?

SS: From our perspective, we have just begun to reveal the potential of real-world data. Five years ago we could not have fathomed that we would have this enormous amount of data aggregated across a specific disease area from which we can extract quality information.

Projecting forward five years from now, I imagine that the digital health field and the bio-pharmaceutical industry will continue to work together, as we are with Flatiron, and that both the quality and volume of data will grow significantly.

At BMS, we have discrete goals to use digital health for translational, regulatory and commercial purposes. It’s imperative that the field continue to evolve, and we’re really optimistic about the future.

What is your thinking on the definition of endpoints when using real-world data, and in your ongoing work with FDA to develop regulatory-grade information? I imagine isolating the effects of specific drugs, say, in cancer patients in the real-world setting might not be the easiest thing to do.

SS: That’s a very interesting question, one that we think about, not just in oncology, but also in areas like fibrosis and NASH (nonalcoholic steatohepatitis) where the FDA, to date, has required liver biopsies as an endpoint to understand the effects of a drug on fibrosis in the liver.

Contemplating clinical endpoints is very important when we start thinking early in discovery about which targets and pathways to modulate. We continually challenge ourselves by asking if perturbing those cellular pathways will lead to a disease phenotypic change, which we can measure by endpoints that align with those that the regulatory agencies would find acceptable. That’s incredibly important to us, especially in translational medicine.

To your question, we, along with others in the industry, will be looking at these large, aggregated datasets to potentially help define new endpoints. Perhaps the FDA will someday consider data that’s not from multiple, small clinical trial datasets, but rather results from very large ‘synthetic’ populations of tens of thousands of cancer patients, as a potential control arm, and with biomarkers or endpoints resulting in a meaningful change in the patient’s disease or quality of life, which we should consider investigating.

I think we’re at the start of helping to define those endpoints. One advantage of using real-world data is on hypothesis generation. It’s possible to identify interesting hypotheses about patient responses in real-world datasets because these datasets often have the size needed to power discovery of weak or low prevalence signals.

That’s important, because with large datasets you can identify signals you otherwise wouldn’t have been able to identify in smaller clinical trial datasets. There are a number of studies being published in Science and Nature on these types of small-ish patient populations. The reports often identify markers or other features that have large effect sizes, but with large datasets you can identify weaker signals which may be just as meaningful. We can then attempt to confirm those hypotheses in clinical trials either retrospectively or potentially prospectively.

Will you be sharing all or part of the results of your analyses with Flatiron and FDA?

SS: This is a collaboration and collaboration involves sharing. We will identify on a case-by-case basis which datasets make sense to share. Importantly, we start with the question we’re trying to answer and how best to answer the question. Then we determine whether to use Flatiron’s data, our data and/or an aggregate of the two, to identify interesting discoveries.

Does the Roche Group’s ownership of Flatiron in any way impact your relationship with Flatiron?

SS: We feel that our relationship and our ability to collaborate with Flatiron has not changed as a result of the Roche acquisition. Roche has indicated that Flatiron will remain an independent unit, and we expect business as usual.